FHFA: HARP success follows low mortgage rates, February refinance volume strong

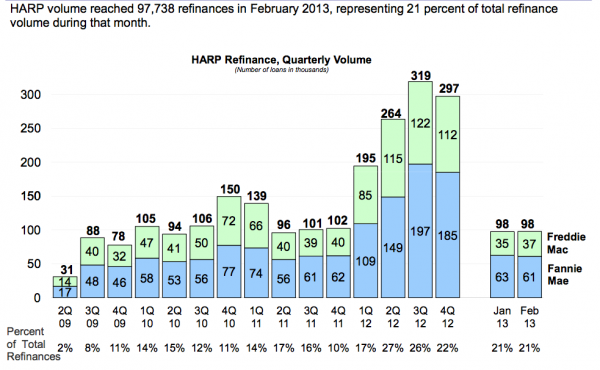

By Gretchen Wegrich Updated on 6/11/2013The Federal Housing Finance Agency (FHFA) released its February 2013 Refinance Report today, revealing elevated refinance volumes as mortgage rates remained at or near historic low levels. The Home Affordable Refinance Program (HARP) played a major role; Of the more than 463,000 refinances that took place in February, 97,738 were completed through HARP, bringing the total number of HARP refinance to more than 2.3 million since the program was first created in April 2009.

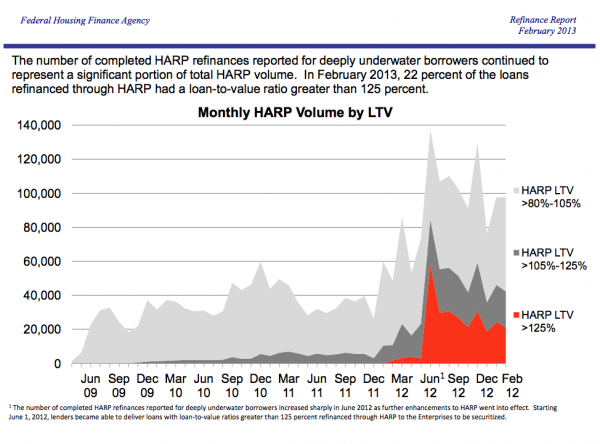

February's HARP refinance volume equaled 21 percent of the total refinance volume.Of the loans refinanced under HARP in February, 22 percent has loan-to-value ratios greater than 125 percent.

HARP, which was set to expire December 31 of this year, was recently extended by FHFA for an additional two years. A nationwide campaign is planned to educate and encourage homeowners to learn about HARP eligibility requirements.

Year-to-date figures through February, borrowers with LTV ratios greater than 105 percent made up 45 percent of HARP loans. Meanwhile, 18 percent of refinances for underwater borrowers were for 15- and 20-year mortgages, implying that homeowners are attempting to build equity faster.

In Nevada, Arizona and Florida, the three states hardest hit by the mortgage crisis, underwater borrowers represented 65 percent or more of HARP volumes.

By state, California borrowers received 329,707 HARP loans, Florida 200,332, Illinois 158,822, Michigan 158,462 and Arizona 117,149.

Didn't find the answer you wanted? Ask one of your own.

-

What You Need To Know About Escrow

View More

What You Need To Know About Escrow

View More

-

President Obama Initiates Lower FHA Mortgage Insurance Premiums

View More

President Obama Initiates Lower FHA Mortgage Insurance Premiums

View More

-

What is Quantitative Easing?

View More

What is Quantitative Easing?

View More

-

The 5 New Mortgage and Housing Trends for Summer 2013

View More

The 5 New Mortgage and Housing Trends for Summer 2013

View More

-

Fannie Mae profitability skyrockets

View More

Fannie Mae profitability skyrockets

View More

-

Foreclosure protections for more soldiers after lawmakers draft bill

View More

Foreclosure protections for more soldiers after lawmakers draft bill

View More

-

Use of Mortgage Interest Deduction Depends on Where You Live

View More

Use of Mortgage Interest Deduction Depends on Where You Live

View More

-

HUD will sell 40,000 distressed loans in 2013

View More

HUD will sell 40,000 distressed loans in 2013

View More

-

Mortgage Principal Reduction Could Save Taxpayers $2.8 Billion

View More

Mortgage Principal Reduction Could Save Taxpayers $2.8 Billion

View More

-

Mortgage Applications Regain Traction after Sluggishness, Rates Continue to Fall

View More

Mortgage Applications Regain Traction after Sluggishness, Rates Continue to Fall

View More

-

HARP 3.0 Discussions Reveal Little Hope for HARP Update

View More

HARP 3.0 Discussions Reveal Little Hope for HARP Update

View More

-

Home Prices Rise in February According to LPS Data

View More

Home Prices Rise in February According to LPS Data

View More

-

Balancing Act: House Committee Hears Opposing Viewpoints Over Mortgage Interest Rate Deduction

View More

Balancing Act: House Committee Hears Opposing Viewpoints Over Mortgage Interest Rate Deduction

View More

-

Near Record Low Mortgage Rates Buoy Housing Recovery

View More

Near Record Low Mortgage Rates Buoy Housing Recovery

View More

-

The Credit Block

View More

The Credit Block

View More

Related Articles

Ask our community a question.

Searching Today's Rates...

Featured Lenders